The LIC maturity form is an essential document for policyholders who have reached the end of their life insurance policies with the Life Insurance Corporation of India (LIC). It serves as a formal request for the maturity benefits that are rightfully owed to you after a significant period of regular premium payments. Understanding the intricacies of this form can help ensure a smooth and hassle-free process, allowing you to claim your benefits without unnecessary delays.

The journey to financial security often involves planning and investments, and life insurance is one of the most reliable means to safeguard your future. When your policy matures, it not only signifies the culmination of your commitment but also opens the door to a range of financial possibilities. Filling out the LIC maturity form correctly is crucial as it determines how swiftly you receive your benefits and what documentation is required, making it an important aspect of the maturity process.

In this article, we will delve into the details of the LIC maturity form, exploring its significance, the steps involved in filling it out, and common questions that policyholders may have. Our goal is to equip you with the knowledge needed to navigate this process effectively, ensuring you can reap the rewards of your investment with ease.

What is the LIC Maturity Form?

The LIC maturity form is a document that policyholders must fill out when their life insurance policy reaches its maturity date. This form is essentially a request for the maturity amount, which includes the sum assured and any bonuses that may have accrued during the policy term. By submitting this form, policyholders initiate the process of receiving their funds from LIC.

Why is the LIC Maturity Form Important?

The importance of the LIC maturity form cannot be overstated. Here are several reasons why it is crucial for policyholders:

- **Claiming Maturity Benefits:** The form is necessary to claim the maturity amount, ensuring that the policyholder receives their entitled benefits.

- **Documentation Requirement:** It serves as a formal request, which is essential for the documentation process within LIC.

- **Avoiding Delays:** Properly filling out the form minimizes the chances of delays in processing your maturity claim.

- **Record Keeping:** It creates an official record of your claim, which can be useful for future reference.

How to Fill Out the LIC Maturity Form?

Filling out the LIC maturity form correctly is vital for a smooth claims process. Here are the steps to follow:

- **Obtain the Form:** You can obtain the LIC maturity form from the LIC office or download it from the LIC website.

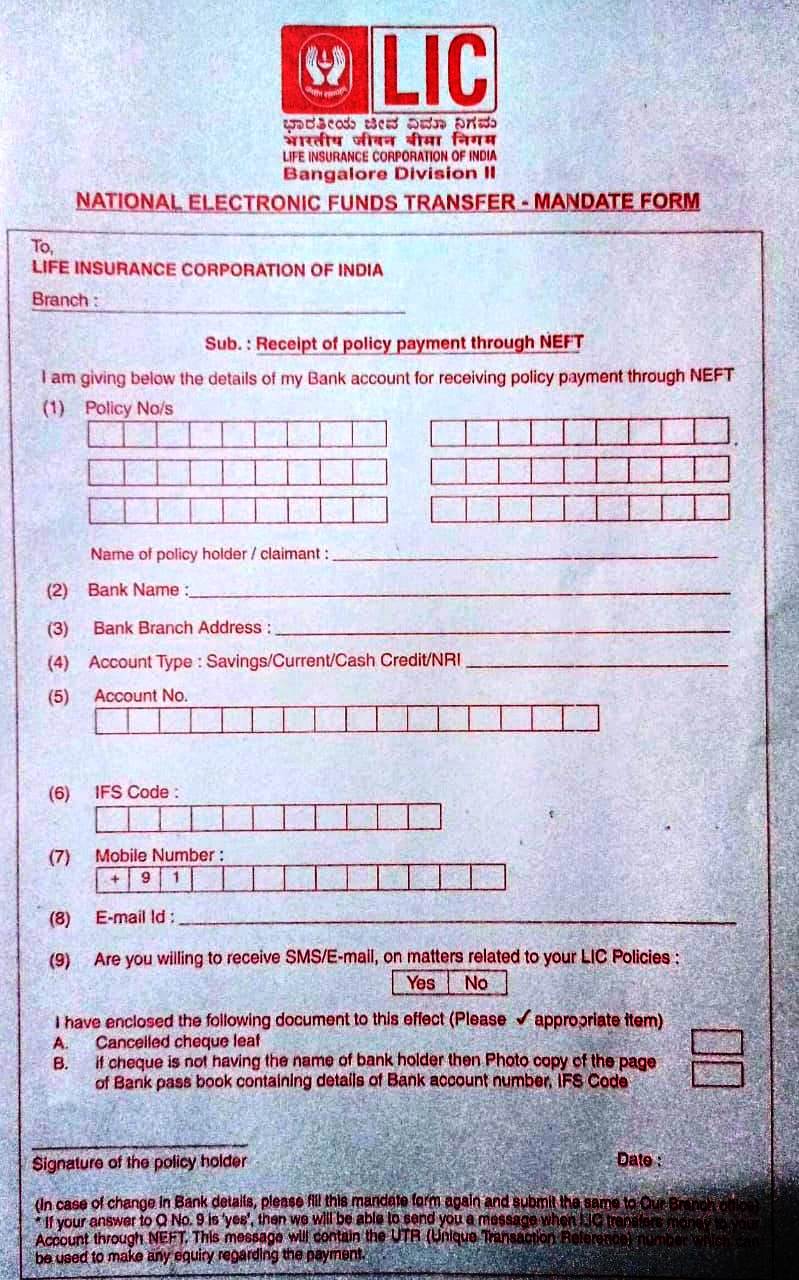

- **Provide Personal Information:** Fill in your personal details, including your name, policy number, and contact information.

- **Details of the Policy:** Mention the details of the policy, including the date of issue, maturity date, and the amount assured.

- **Bank Details:** Include your bank account details where you want the maturity amount to be credited.

- **Signature:** Finally, sign the form to authenticate it.

What Documents are Required Alongside the LIC Maturity Form?

When submitting the LIC maturity form, you will need to provide certain documents to facilitate the claims process. These typically include:

- **Original Policy Document:** This is the primary document that establishes your claim.

- **Identity Proof:** A government-issued ID such as an Aadhar card or passport.

- **Bank Statement:** A recent bank statement may be required to verify your account details.

- **Claim Form (if applicable):** Some policies may require an additional claim form.

Where to Submit the LIC Maturity Form?

The LIC maturity form can be submitted at any LIC branch office. You may also have the option to submit it online through the LIC’s official website, depending on the specific policies and regulations in place. It’s advisable to check the latest guidelines from LIC to ensure you are following the correct procedure.

How Long Does It Take to Process the LIC Maturity Form?

The processing time for the LIC maturity form can vary depending on several factors. Generally, once the form and all required documents are submitted, the processing time can take anywhere from a few days to a few weeks. Factors affecting this timeline include:

- **Completeness of Documents:** If all required documents are submitted, it speeds up the process.

- **Verification Process:** The time taken for LIC to verify the submitted information can affect processing times.

- **Volume of Claims:** During peak times, such as the end of the financial year, there may be delays due to a high volume of claims.

What to Do If Your LIC Maturity Form is Rejected?

If your LIC maturity form is rejected, it can be disheartening. However, it’s important to understand the reasons for the rejection and how to address them. Common reasons for rejection include:

- **Incomplete Information:** Ensure that all sections of the form are filled out accurately.

- **Missing Documents:** Double-check that you have attached all necessary documents.

- **Policy Issues:** Verify that your policy is indeed eligible for maturity benefits.

If your form is rejected, you can contact LIC customer service for clarification and guidance on how to rectify the issue.

Conclusion: Navigating the LIC Maturity Form Process

In conclusion, the LIC maturity form is a fundamental component of claiming your maturity benefits from LIC. By understanding its importance, the necessary steps to fill it out, and knowing what documents are required, you can streamline the claims process and avoid potential pitfalls. Remember to keep copies of all submitted documents for your records and stay informed about any updates from LIC regarding your application. With the right approach, you can ensure that your hard-earned benefits are rightfully yours at the end of your policy term.

Article Recommendations

- Jerry Lorenzo Dad

- Who Is Felicity In Arrow

- Cuanto Tiempo Gobernara Donal Trump

- Who Plays Ally In Austin And Ally

- How Old Is Helena Vestergaard

- Jason Momoa Amber Heard

- Carta Astral Donal Trump

- Chantel And Pedro

- Goojara App

- How Many Female Governors