In the world of statistics and probability, understanding concepts like expected value and variance is crucial for making informed decisions. Whether you are a student, a statistician, or an enthusiast, the expected value and variance calculator is a powerful tool that can simplify complex calculations and enhance your understanding of data analysis. This article will delve into the significance of expected value and variance, explain how to use the calculator effectively, and provide insights into its practical applications.

Expected value represents the average outcome of a random variable, providing a single measure that summarizes the entire probability distribution. Variance, on the other hand, quantifies the spread or dispersion of that distribution, indicating how much the outcomes differ from the expected value. By utilizing an expected value and variance calculator, users can quickly determine these essential statistics without the need for tedious manual calculations. This tool is especially useful in fields such as finance, gaming, and risk assessment.

As we explore the functionalities and benefits of the expected value and variance calculator, we will address common questions and scenarios where these concepts apply. From investment strategies to game theory, understanding how to calculate and interpret expected value and variance can lead to better decision-making and improved outcomes.

What is Expected Value?

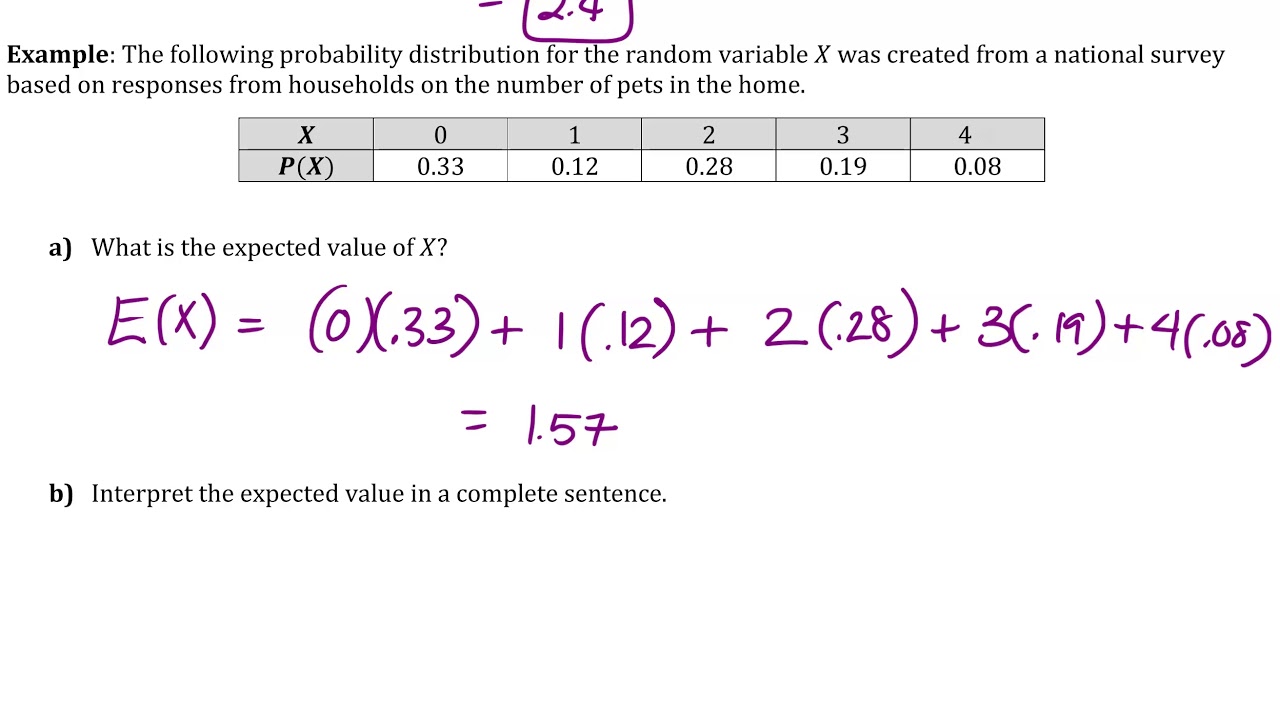

The expected value (EV) is a fundamental concept in probability theory that calculates the average outcome of a given event when considering all possible outcomes and their associated probabilities. It is mathematically defined as:

- EV = Σ (Probability of Outcome × Value of Outcome)

This formula allows individuals to weigh the potential benefits against the likelihood of different scenarios occurring, ultimately leading to more informed choices.

How is Expected Value Used in Real Life?

Expected value has wide-ranging applications across various fields. Here are some common scenarios:

- Investment Analysis: Investors use expected value to assess the potential return on investment by evaluating different market scenarios.

- Game Strategy: In games of chance, players determine their best strategy by calculating the expected value of different moves.

- Insurance: Actuaries use expected value to estimate risks and determine appropriate premium rates.

Can You Calculate Expected Value for Continuous Variables?

Yes, expected value can also be calculated for continuous random variables using integral calculus. The formula is:

- EV = ∫ (x * f(x) dx)

Where f(x) represents the probability density function. This approach helps in scenarios where outcomes are not discrete.

What is Variance?

Variance is another critical statistical measure that provides insights into the distribution of data points around the mean. It is defined as:

- Variance = Σ (Probability of Outcome × (Value of Outcome - Expected Value)²)

By calculating variance, individuals can understand the degree to which outcomes deviate from the average, which is vital for risk assessment and decision-making.

How Can Variance Benefit Decision-Making?

Understanding variance is essential for evaluating risk. Here are some key benefits:

- Risk Assessment: High variance indicates a wider range of potential outcomes, signaling greater risk.

- Portfolio Management: Investors use variance to diversify their portfolios, balancing risk and return.

- Quality Control: In manufacturing, variance helps identify inconsistencies in production processes.

What is the Relationship Between Variance and Standard Deviation?

Variance and standard deviation are closely related statistical measures. Standard deviation is simply the square root of variance. It provides a more interpretable scale for dispersion, making it easier to understand the variability of data. The formulas are:

- Variance = σ²

- Standard Deviation = σ

How Does the Expected Value and Variance Calculator Work?

The expected value and variance calculator simplifies the process of calculating these statistics. Here are the basic steps:

- Input all possible outcomes and their probabilities into the calculator.

- Press the calculate button to obtain the expected value and variance.

- Interpret the results to inform your decision-making process.

This user-friendly tool eliminates the complexity of manual calculations, allowing users to focus on analysis and strategy.

What Are the Advantages of Using an Expected Value and Variance Calculator?

There are numerous advantages to using an expected value and variance calculator:

- Time-Saving: Quickly computes results without detailed manual calculations.

- Accuracy: Reduces the risk of human error in calculations.

- User-Friendly: Accessible and easy to use for individuals at any skill level.

- Versatility: Can be applied to various fields and scenarios, from finance to gaming.

Where Can You Find an Expected Value and Variance Calculator?

You can find expected value and variance calculators on various online platforms, including educational websites, financial tools, and statistical software. Many universities and academic institutions also provide these calculators as part of their statistics resources.

Conclusion: How Can You Leverage the Expected Value and Variance Calculator for Better Outcomes?

The expected value and variance calculator is an invaluable tool that empowers individuals to make informed decisions based on statistical analysis. By understanding and applying these concepts, you can enhance your analytical skills and improve your decision-making processes across various domains. Whether you are making investment choices, strategizing in games, or assessing risks, leveraging the expected value and variance calculator can lead to better outcomes and increased success.

Article Recommendations

- How Old Was Michael J Fox Back To The Future

- Rod Steart Age

- Is Shirley Caesar Alive Today

- Cuanto Tiempo Gobernara Donal Trump

- What Nationality Is Nico Iamaleava

- What Is Tortured Poets

- How Many Seasons Is Steve On Shameless

- Anime Character Male

- What Team Does Anthony Rizzo Play For

- Jerry Lorenzo Dad